Navigating Market Volatility: Understanding the 'Pain Trade'

The world of finance is exciting—but also unforgiving. Especially for traders and investors, market volatility often feels like riding a roller coaster. One of the most misunderstood yet crucial phenomena during volatile times is something traders call the “Pain Trade.”

But what exactly is the Pain Trade? Why does it trap even experienced investors? And most importantly, how can awareness of it lead to smarter financial decisions?

Let’s explore this powerful concept and discover how institutions like YourPaathshaala in Mathpurena, Raipur, help students grasp such real-world financial topics early in their learning journey.

💥 What Is the ‘Pain Trade’?

The Pain Trade is a term used in the world of trading to describe the market movement that causes the most discomfort to the largest number of investors or traders. It typically happens when:

Most traders are over-leveraged in one direction (either too bullish or too bearish).

A sudden move in the opposite direction catches them off guard.

They are forced to exit their positions, often at a loss.

The result? Massive liquidations, short squeezes, or stop-loss triggers—all of which amplify the market move and the pain felt by those involved.

📊 How Does the Pain Trade Work?

Let’s break this down with a simplified example:

Imagine This Scenario:

Most traders expect a stock to fall, so they short it.

Suddenly, positive news comes out, and the price shoots up.

All those who shorted the stock now face huge losses and must cover their shorts by buying back the stock—pushing the price even higher.

This creates a short squeeze, which is a classic example of a Pain Trade.

The Pain Trade doesn’t just impact short-sellers—it happens in bullish scenarios too. When everyone is overly optimistic and prices suddenly crash, the result is similar panic and forced selling.

🧠 Why Awareness of the Pain Trade Is Important

Understanding the Pain Trade helps traders and investors:

📉 Avoid overexposure to one-sided market sentiments.

🛡️ Use proper risk management tools (like stop-losses and diversified portfolios).

🤔 Think contrarian—going against the crowd can sometimes be profitable.

📈 Make informed, emotion-free decisions.

For students and learners, the Pain Trade offers valuable lessons in behavioral finance, technical analysis, and market psychology—critical areas in commerce, economics, and competitive exam preparation.

🔍 Technical Factors Behind the Pain Trade

1. Leverage

Leverage lets traders control large positions with small capital. While it boosts potential profits, it also amplifies losses.

In volatile markets, this leverage can trigger margin calls, forcing traders to exit positions at the worst time—creating more volatility.

2. Stop-Loss Orders

Stop-losses are meant to protect traders, but when many are placed at similar price levels, a sharp move can trigger massive selling or buying.

This accelerates the Pain Trade, turning a small movement into a significant shift.

3. Liquidity Crunch

In fast markets, liquidity dries up—meaning there are fewer buyers or sellers. Orders slip (called slippage), and prices jump quickly, causing more panic.

🧾 Lessons from the Pain Trade for Students

Understanding these concepts is not just for traders on Wall Street—it’s for students preparing to become financial analysts, entrepreneurs, economists, and investors in the future.

At YourPaathshaala, located in Tagore Nagar, Mathpurena, Raipur, we go beyond textbooks. Our coaching emphasizes real-world applications of economic principles, such as:

How markets behave under pressure

The role of psychology in investing

Practical finance and money management

These concepts help students not just pass exams, but also develop a financial mindset that will benefit them in life.

📚 The Role of Psychology in the Pain Trade

The Pain Trade is not just about charts and technicals—it’s deeply psychological.

Cognitive Biases Involved:

Herd Mentality: Traders follow the crowd, leading to over-concentration.

Overconfidence: Believing the market will move as expected causes risky behavior.

Loss Aversion: Traders hold on to losing positions too long, fearing to book losses.

Understanding these biases is crucial to success—not just in trading, but in decision-making and leadership, traits that YourPaathshaala helps instill in every student.

🏫 YourPaathshaala: Building Financial Intelligence in Raipur

At YourPaathshaala, we believe that education should evolve with the times. That’s why we:

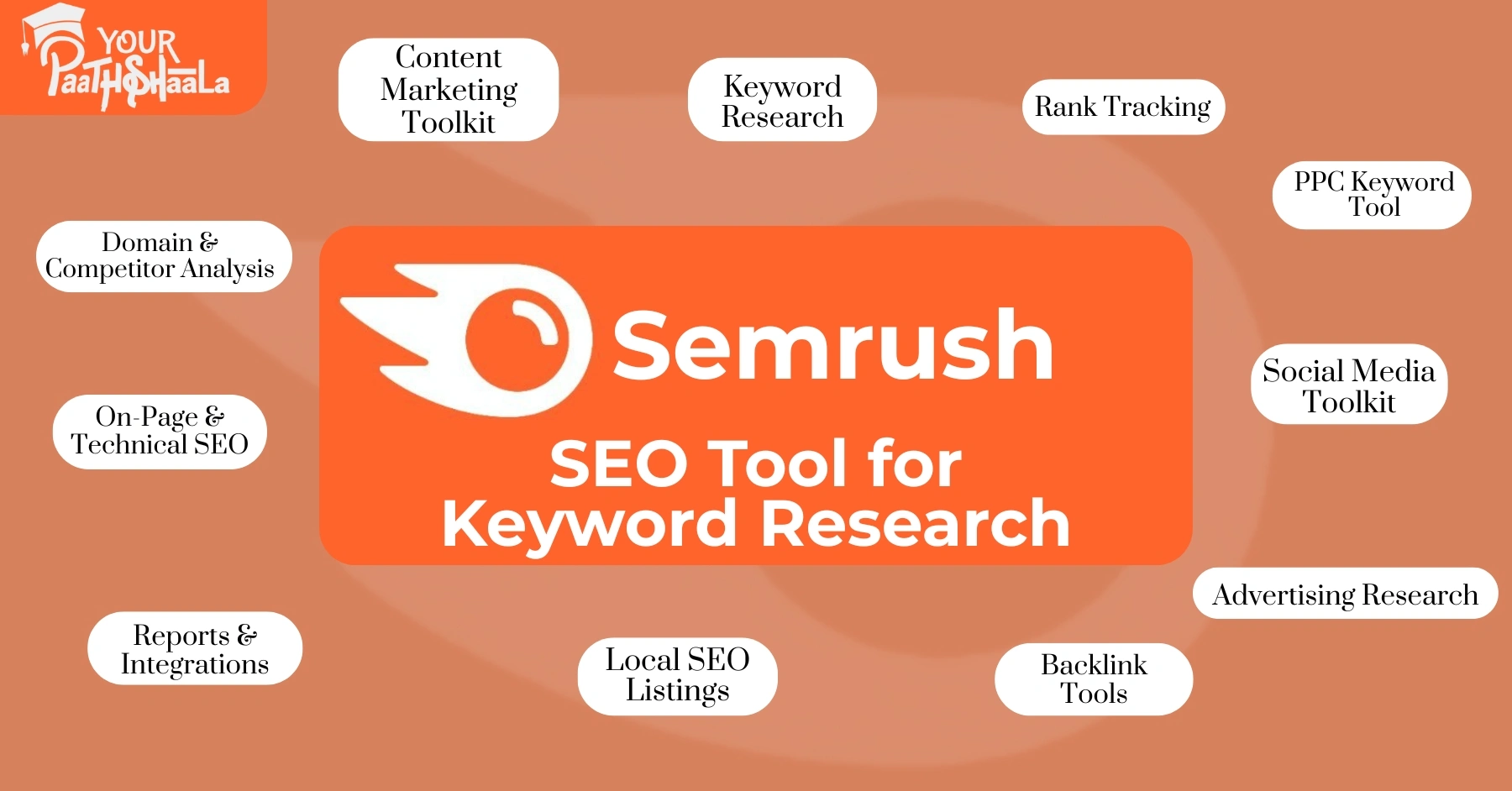

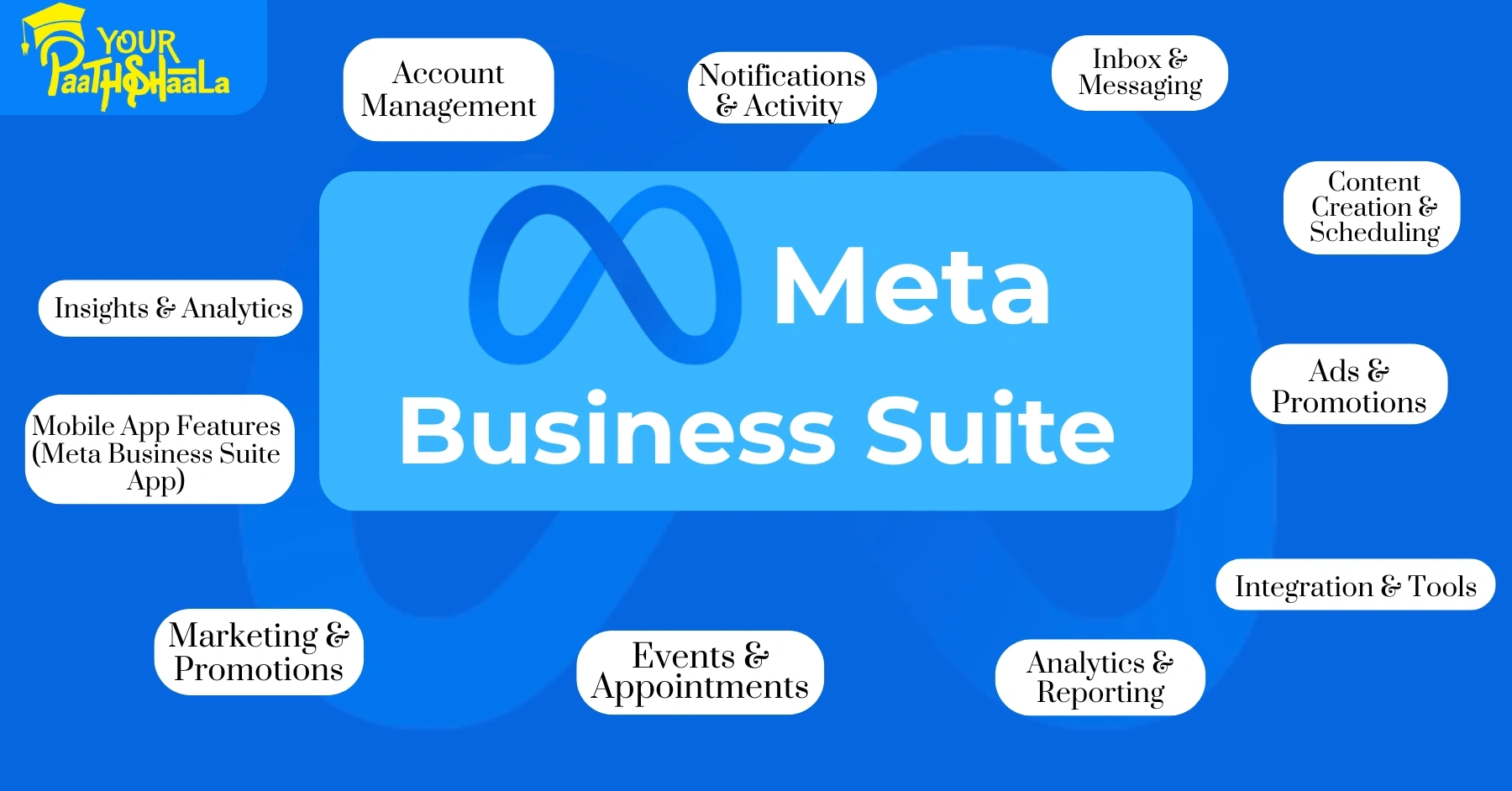

✅ Teach with current affairs and market-based examples.

✅ Encourage students to explore topics like stock markets, cryptocurrency, digital economy, and global trade.

✅ Offer coaching in Commerce, Economics, Social Science, and more.

We prepare students for competitive exams, college admissions, and career challenges by focusing on concept clarity, critical thinking, and real-world application.

📍 Visit YourPaathshaala Today!

Your future in finance, business, or economics starts with the right foundation. And there’s no better place to begin than YourPaathshaala.

📌 Location: Near 🏥 Anjali Children Hospital, Tagore Nagar, Mathpurena, Raipur

📫 PIN: 492001, Chhattisgarh

📞 Click the Call Now to get in touch and learn how we can help shape your academic and career success.

Whether you’re a student curious about economics or a parent seeking quality education for your child—YourPaathshaala is here for you.

🔚 Conclusion

The Pain Trade is a powerful reminder that markets move not just on logic, but also emotion, pressure, and psychology. By studying such trends, students can develop financial awareness early on, giving them an edge in any field they pursue.

And that’s exactly what YourPaathshaala offers—not just education, but enlightenment.

Add a Comment