Mastering Short-Term Trading: A Beginner’s Guide to Quick Profits and Smart Decisions

In today’s fast-paced financial markets, short-term trading has become one of the most popular ways for investors and traders to capitalize on small price movements to generate quick profits. Unlike long-term investing, which focuses on holding assets for months or years, short-term trading involves buying and selling financial instruments like stocks, currencies, or commodities within days, hours, or even minutes.

If you’re curious about short-term trading, eager to learn proven techniques, or want to sharpen your timing and decision-making skills, this guide will walk you through everything you need to know to get started successfully.

What is Short-Term Trading?

Short-term trading is a trading style that aims to exploit small price fluctuations over a brief period. Traders buy assets with the intention to sell them quickly, capturing profits from minor changes in the market.

There are several types of short-term trading strategies, including:

Day Trading: Buying and selling securities within the same trading day before the market closes.

Swing Trading: Holding positions for several days to weeks to capitalize on expected market swings.

Scalping: Making multiple trades within seconds or minutes to take advantage of tiny price movements.

Because short-term trading requires rapid decisions and quick execution, it’s often preferred by traders who enjoy an active role in the markets.

Why Choose Short-Term Trading?

Short-term trading appeals to many because:

Quick Profits: Traders can generate profits faster than with long-term investing.

More Trading Opportunities: Frequent trades mean more chances to profit from different market movements.

Flexibility: Short-term traders can react quickly to news and market events.

Limited Exposure: Positions are held briefly, reducing risk from overnight market gaps.

However, it’s important to remember that short-term trading also involves higher risk due to rapid market fluctuations and the need for precise timing.

Essential Techniques for Short-Term Trading

Mastering short-term trading requires knowledge of the most common and effective techniques. Here are two popular methods:

1. Day Trading

Day trading means opening and closing trades within the same day, often multiple times. Day traders rely on technical analysis, charts, and patterns to identify entry and exit points.

Key characteristics:

Positions are not held overnight.

Requires constant market monitoring during trading hours.

Uses leverage to amplify small price moves.

2. Swing Trading

Swing trading takes a slightly longer approach, holding positions from a few days up to a few weeks. Swing traders aim to catch larger “swings” in the market by analyzing trends and momentum.

Key characteristics:

Trades last longer than a day but less than a few weeks.

Relies on both technical and fundamental analysis.

Less time-intensive than day trading.

Tools and Indicators to Help You Succeed

Successful short-term trading depends heavily on understanding market data and using the right tools. Here are some essential tools every trader should master:

Candlestick Charts: Visual representations of price movements that help identify patterns.

Moving Averages: Help smooth out price data to identify trends.

Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

Bollinger Bands: Show volatility and potential price reversals.

Volume Analysis: Tracks trading volume to confirm price trends.

These tools, combined with disciplined risk management, can significantly improve your chances of success.

The Importance of Timing and Decision-Making

In short-term trading, timing is everything. Knowing exactly when to enter and exit trades can mean the difference between a profit and a loss.

Set Clear Entry and Exit Points: Always plan your trade before entering. Know your target price and stop-loss level.

Follow Your Trading Plan: Discipline is critical. Stick to your strategy even when emotions run high.

Manage Risks Carefully: Use stop-loss orders to limit potential losses.

Stay Updated: Keep an eye on economic news and events that might impact the markets.

Quick decision-making is a skill that develops with experience. New traders should start with a demo account to practice without risking real money.

Risks to Keep in Mind

Short-term trading can be rewarding but is not without risks:

Market Volatility: Prices can move rapidly and unpredictably.

Emotional Stress: The pressure of quick decisions can lead to mistakes.

Transaction Costs: Frequent trading may increase fees and commissions.

Leverage Risks: Using borrowed money amplifies both gains and losses.

Understanding these risks is crucial before committing significant capital to short-term trading.

How to Get Started with Short-Term Trading

Here are simple steps to begin your journey:

- Educate Yourself: Learn about trading strategies, chart analysis, and risk management.

- Choose a Reliable Broker: Look for low fees, fast execution, and a good trading platform.

- Develop a Trading Plan: Define your goals, risk tolerance, and strategy.

- Practice on a Demo Account: Simulate trading to build confidence.

- Start Small: Use small amounts of money initially to limit risk.

- Keep Learning: Continuously analyze your trades and improve your methods.

Why Training and Support Matter: Visit YourPaathshaala

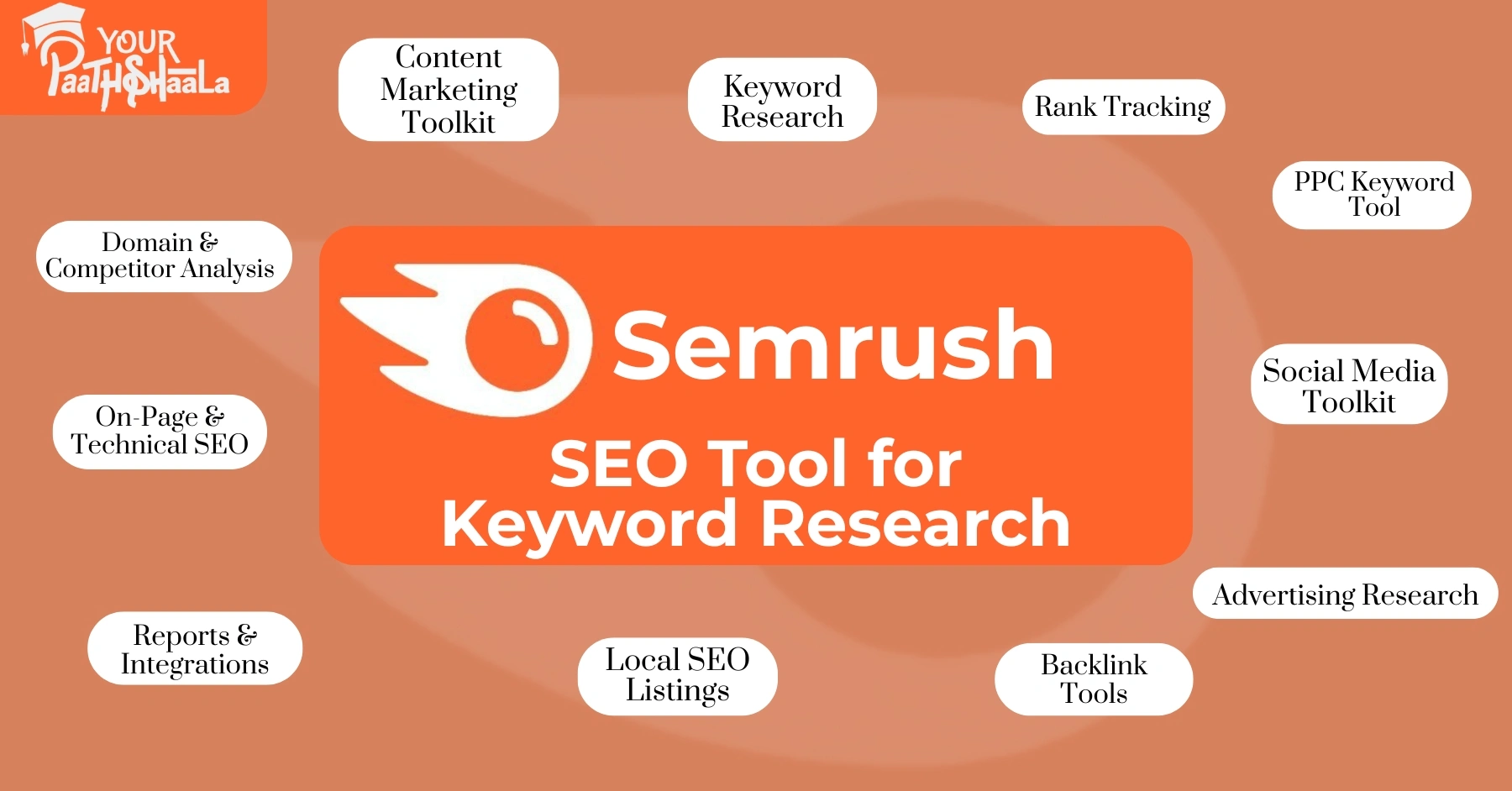

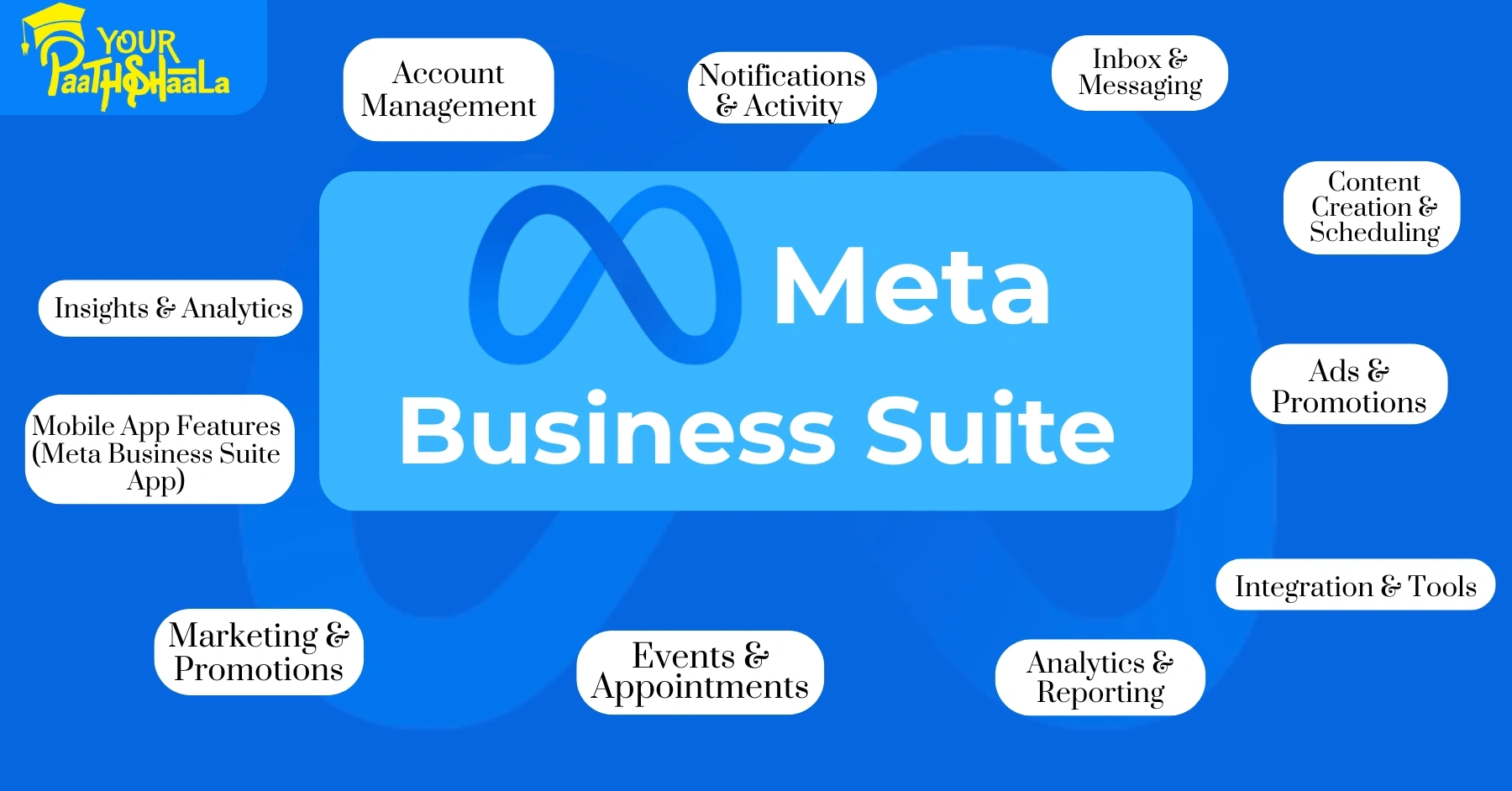

If you’re serious about mastering short-term trading, the right guidance can accelerate your learning curve. YourPaathshaala, located near Anjali Children Hospital in Tagore Nagar, Mathpurena, Raipur (PIN 492001, Chhattisgarh), offers expert training programs tailored for beginners and aspiring traders.

At YourPaathshaala, you’ll get:

Comprehensive courses on short-term trading strategies.

Hands-on practice sessions.

Personalized mentoring.

Supportive learning environment.

Access to real-time market tools.

Ready to take the next step in your trading journey?

📞 Click the Call Now to contact us and enroll!

Final Thoughts

Short-term trading can be an exciting and potentially profitable way to participate in financial markets. With the right education, tools, and mindset, you can learn to navigate fast-changing markets and make smart trading decisions.

Remember, success won’t happen overnight. Be patient, practice consistently, and always manage your risks carefully.

Whether you’re completely new or looking to sharpen your skills, YourPaathshaala in Raipur is here to help you unlock your full trading potential.

Start mastering short-term trading today, and take control of your financial future! And read the full article in stockmarketcourseinraipur.in

[…] Mastering Short-Term Trading […]

[…] Mastering Short-Term Trading […]