How to Build a Successful Trading Plan: A Complete Guide for Beginners

Creating a solid trading plan is one of the most essential steps toward becoming a consistent and confident trader. Whether you are a beginner or have some experience in the markets, having a clear and structured plan can make the difference between long-term success and repeated mistakes.

In this article, we’ll walk you through the importance of a trading plan, the components that make it effective, and how you can create your own trading strategy with discipline and clarity.

📌 What is a Trading Plan?

A trading plan is a written set of rules that outlines how a trader will enter, manage, and exit trades based on market conditions. It acts as a roadmap that helps you avoid emotional decisions and stick to your strategy, even during volatile market conditions.

Think of it like a business plan — you wouldn’t start a business without one, and trading is no different.

✅ Why Do You Need a Trading Plan?

A trading plan gives you structure and helps you:

Stay focused on your financial goals

Manage risk effectively

Avoid impulsive decisions based on emotions

Improve your consistency over time

Track performance and make improvements

Many beginner traders skip this step and end up gambling in the markets instead of trading with purpose.

🎯 Key Components of a Successful Trading Plan

Here are the most important elements your trading plan should include:

1. Your Trading Goals

Start by defining what you want to achieve from trading.

Are you trading for extra income?

Do you want to grow long-term wealth?

How much return are you aiming for monthly or annually?

Set realistic goals and break them into short-term and long-term objectives.

2. Market Focus

Choose which financial markets you will trade in:

Stocks

Forex

Commodities

Cryptocurrencies

Indices

Focusing on a specific market helps you specialize and reduces confusion.

3. Trading Strategy

Your plan should clearly explain your entry and exit strategy:

What signals will you use to enter a trade?

What indicators or chart patterns will guide you?

What conditions will trigger your exit?

This can include technical indicators like RSI, moving averages, price action, support/resistance, or news-based strategies.

4. Risk Management Rules

This is one of the most important sections of your trading plan.

Set limits for:

Risk per trade (e.g., 1–2% of your capital)

Stop-loss levels

Maximum daily/weekly losses

Position size

Good risk management protects your account even when you have losing trades — which every trader does.

5. Trading Schedule

Decide when you will trade:

Are you a day trader, swing trader, or position trader?

Will you trade during market open, close, or mid-session?

How many hours per day can you dedicate?

Having a schedule adds discipline and prevents overtrading.

6. Psychological Preparation

Trading is not just about strategies — it’s a mental game too.

Write down how you will handle:

Stress during losses

Overconfidence after wins

The temptation to break your rules

You can even create a mental checklist before each trading session to stay calm and focused.

7. Performance Review

Track and review your trades weekly or monthly.

What worked well?

What mistakes did you make?

Are you following your trading rules?

Keep a trading journal to document every trade and analyze your progress.

📊 The Power of Consistency and Discipline

A great trading plan is useless if you don’t follow it. The two biggest keys to trading success are:

🔁 Consistency:

Follow your strategy every time — no exceptions. Even a perfect system won’t work if you only follow it 60% of the time.

🧠 Discipline:

Stick to your stop-loss. Don’t chase trades. Wait for your setup. Over time, disciplined trading wins, even with a moderate strategy.

👣 Steps to Create Your Own Trading Plan

Here’s a step-by-step breakdown to build your first trading plan:

- Write down your financial goals

- Choose your preferred market and trading style

- Define your trade entry and exit rules

- Set risk limits and capital management rules

- Establish your daily trading routine

- Prepare for emotional ups and downs

- Track every trade and review performance regularly

You don’t need a complicated strategy — you need a clear, repeatable process.

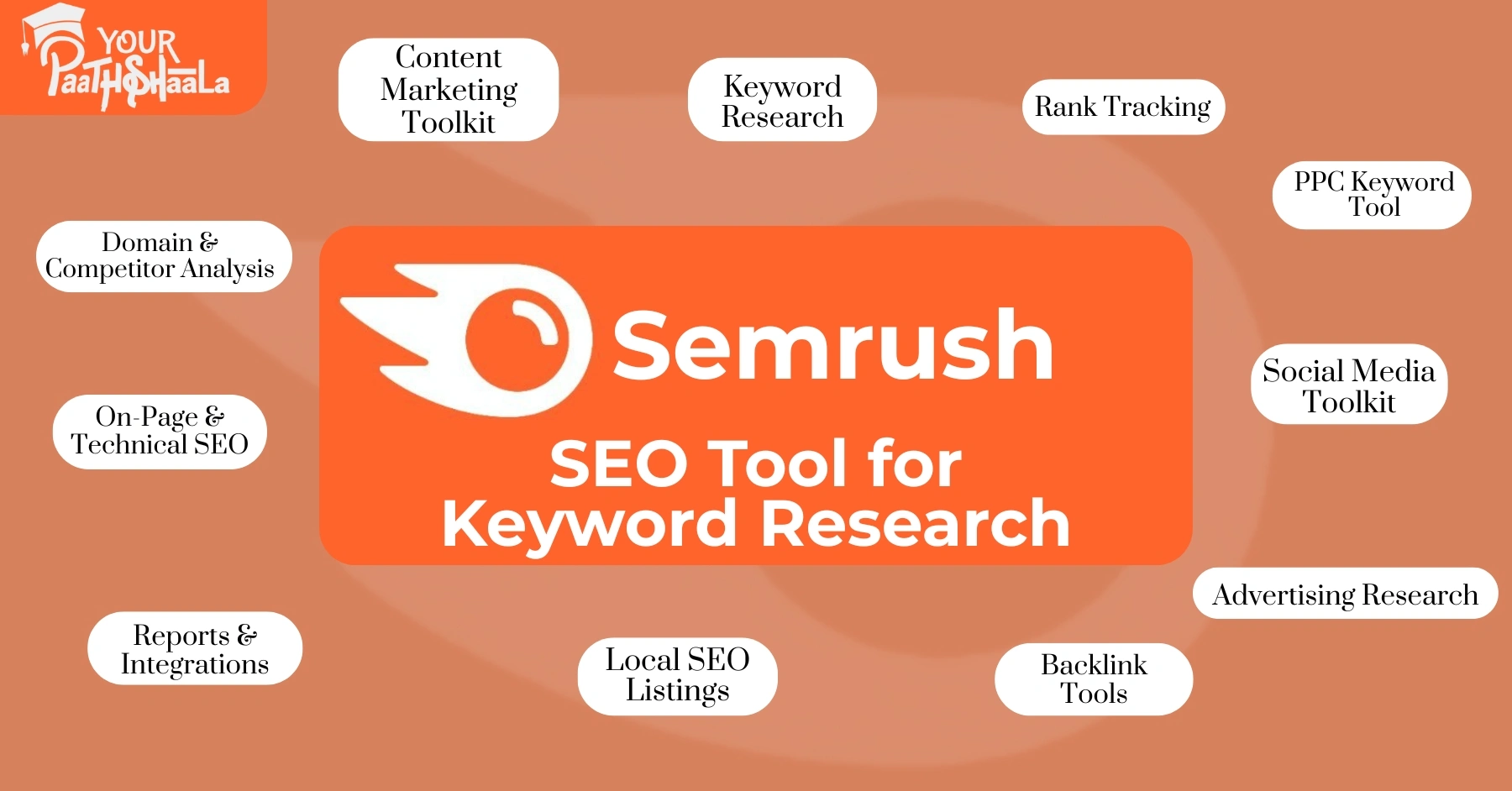

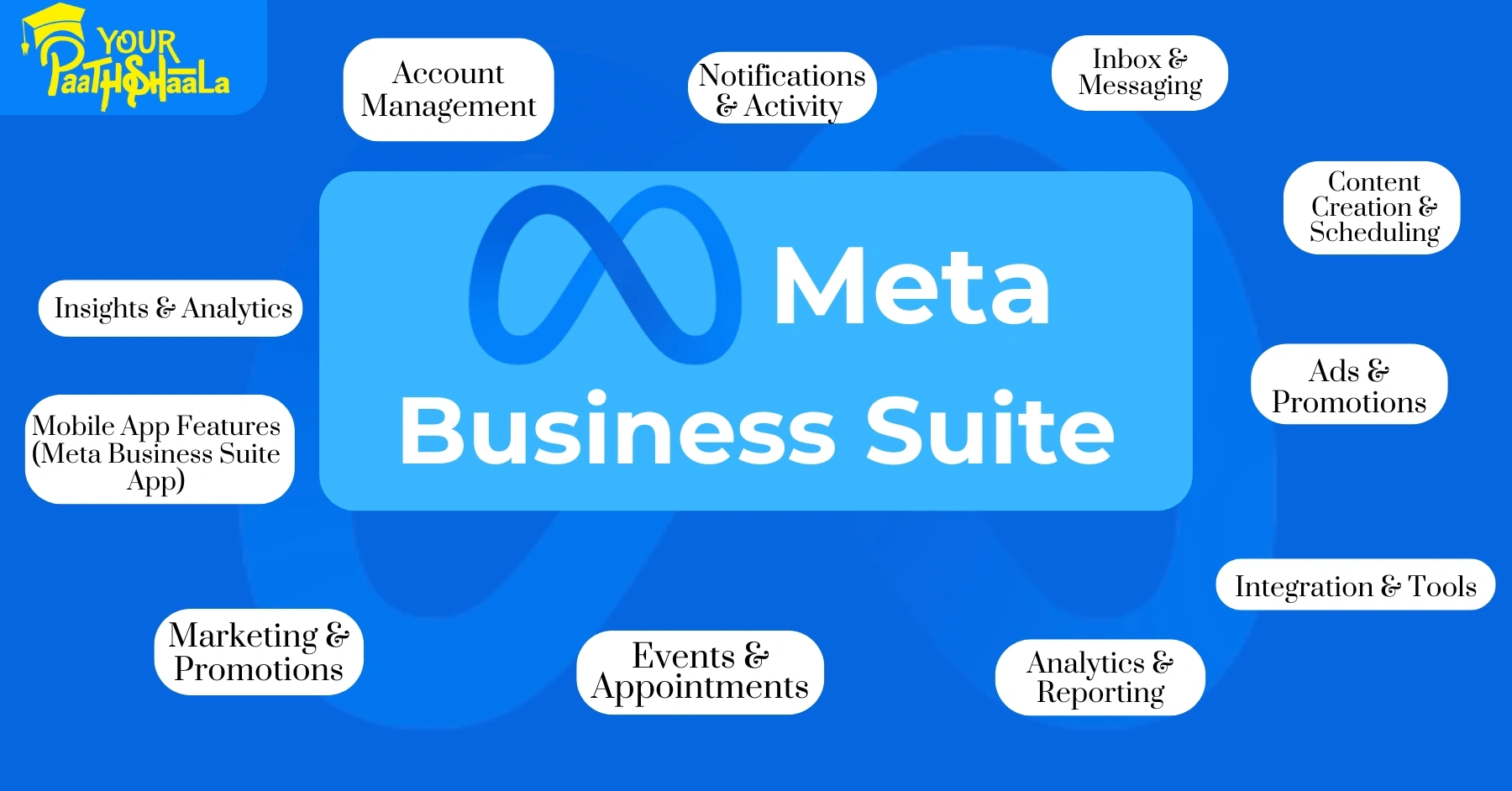

🏫 Learn Trading with Experts at YourPaathshaala

At YourPaathshaala, located in the heart of Raipur, we offer beginner-friendly trading education. Our expert mentors guide you in understanding:

Market structure and psychology

Technical analysis

Risk management

Creating and backtesting trading plans

We aim to empower you with the skills and confidence needed to succeed in the financial markets.

📍 Visit YourPaathshaala

Near 🏥 Anjali Children Hospital, Tagore Nagar, Mathpurena, Raipur

📫 PIN: 492001, Chhattisgarh

📞 Click the Call Nowto contact us and start your trading journey the right way! Check out the full article on stockmarketcourseinraipur.in

Add a Comment