Understanding Derivatives: A Simple Guide to Futures and Options in Trading

In today’s fast-paced financial world, derivatives like futures and options play a crucial role in managing risk and maximizing profits. Though often considered complex, understanding how they work can open up new opportunities for traders and investors.

Whether you’re new to trading or want to sharpen your strategy, this guide will help you understand the basics of derivatives, their purpose, and how you can use them wisely.

🔍 What Are Derivatives?

Derivatives are financial contracts whose value is based on an underlying asset such as stocks, commodities, currencies, or indices.

In simpler terms, they “derive” their price from something else. The two most commonly traded derivatives are:

Futures

Options

Both can be used for hedging (risk protection) or speculation (profit from price movements).

📊 What Are Futures?

Definition:

A futures contract is an agreement to buy or sell an asset at a predetermined price on a specific future date.

Example:

Suppose you expect the price of gold to rise. You buy a gold futures contract today, agreeing to buy it at ₹60,000 per 10g after 3 months. If gold rises to ₹65,000, you make a profit by buying low and selling high.

Key Features:

Standardized contracts traded on exchanges.

Obligatory – must be settled on the expiry date.

Requires margin money (a percentage of the total trade value).

🧾 What Are Options?

Definition:

An options contract gives the buyer the right, but not the obligation, to buy or sell an asset at a specific price on or before a set date.

There are two types:

Call Option: Right to buy

Put Option: Right to sell

Example:

You buy a call option on Reliance shares at ₹2,500. If the price rises to ₹2,700, you can buy at ₹2,500 and sell at ₹2,700—making a profit.

Key Features:

Non-obligatory – you can choose not to exercise the option.

Premium is paid upfront.

Limited risk for the buyer but unlimited potential profit.

⚠️ Risks Involved in Futures and Options

Futures and options are advanced tools, and while they offer high-profit potential, they also carry significant risks:

Leverage risk: You trade large amounts with little capital. A small price change can lead to big losses.

Expiry pressure: Both contracts have expiry dates. If your prediction doesn’t play out in time, you lose money.

Complexity: Without proper knowledge, it’s easy to make costly mistakes.

🧠 Why Do Traders Use Futures and Options?

1. Hedging

Big companies or investors use derivatives to protect their portfolios from price fluctuations.

Example: An airline might hedge against rising fuel prices using futures contracts.

2. Speculation

Many traders use F&O to profit from market movements, both upward and downward.

Example: If you believe the Nifty index will rise, you might buy a call option on Nifty.

3. Arbitrage

Traders take advantage of price differences between the spot market and the futures market for the same asset.

💡 Key Differences Between Futures and Options

| Feature | Futures | Options |

|---|---|---|

| Obligation | Must be fulfilled | Can be skipped |

| Risk | Higher | Lower for buyer |

| Premium | No premium paid | Premium paid |

| Profit/Loss | Unlimited | Profit is unlimited, loss is limited for buyers |

| Use | Mostly speculation & hedging | Hedging & speculation |

🧾 Basic Terms You Should Know

Strike Price: Price at which the asset can be bought or sold in an options contract.

Expiry Date: The last date on which the contract is valid.

Premium: The price paid to buy an option.

Lot Size: Minimum quantity of the asset in a contract.

In the Money (ITM): When exercising the option is profitable.

Out of the Money (OTM): When exercising the option leads to a loss.

📈 Real-World Examples

1. Stock Traders

Many traders use options to trade stocks like Reliance, TCS, or Infosys with small capital and large exposure.

2. Commodity Traders

Gold and crude oil are common in futures trading as prices are volatile and offer high potential for gains.

3. Index Trading

Options on Nifty and Bank Nifty are highly liquid and widely traded in India.

🚨 Tips for Beginners in F&O Trading

- Start Small – Never risk all your capital.

- Use Stop-Loss – Always limit your potential losses.

- Avoid Overtrading – Stick to quality trades, not quantity.

- Understand Time Value – Options lose value as they near expiry.

- Practice First – Use demo accounts before entering real trades.

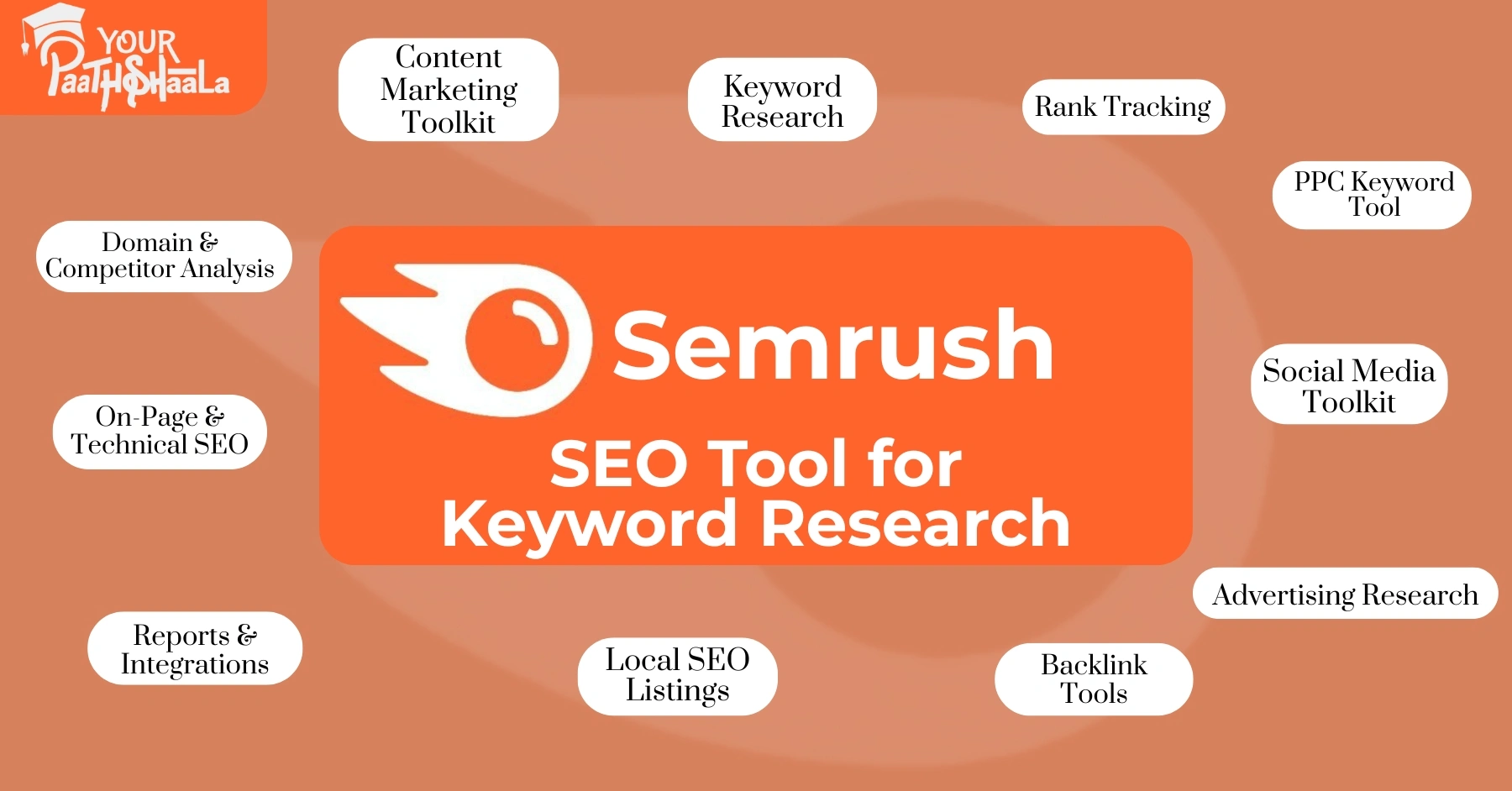

🏫 Learn Futures and Options at YourPaathshaala

Understanding derivatives requires practice, patience, and guidance. At YourPaathshaala, we help beginners and intermediate traders master:

Futures & Options strategies

Risk management techniques

Technical and fundamental analysis

Real-world simulations and mock trading

📍 Visit YourPaathshaala

Near 🏥 Anjali Children Hospital, Tagore Nagar, Mathpurena, Raipur

📫 PIN Code: 492001, Chhattisgarh

📞 Click the Call Now to enroll in our professional trading courses today! For reading full article click here!

[…] Prev Next […]

[…] Prev Next […]

[…] What are Futures and Options? […]

[…] What are Futures and Options? […]

[…] What are Futures and Options? […]

[…] What are Futures and Options? […]

[…] What are Futures and Options? […]

[…] What are Futures and Options? […]

[…] What Is trading strategies gaining popularity means? – YourPaathshaala.in on What are Futures and Options? […]