Smart Diversification Strategies in 2025: Protect and Grow Your Investment Portfolio

In 2025, with global markets experiencing rapid changes, diversification remains one of the most important investment strategies. Whether you’re a beginner or a seasoned investor, spreading your money across different asset classes can reduce risk and improve returns.

In this article, we’ll explore the best diversification strategies in 2025, the benefits they offer, how to apply them effectively, and what new opportunities—like emerging markets and alternative assets—investors should consider.

💡 What Is Diversification?

Diversification is an investment strategy that involves allocating funds across a variety of financial instruments, industries, and other categories to minimize risk. Instead of putting all your money into one type of asset, diversification spreads your investment to ensure that the impact of a loss in any one area is limited.

🧠 Why Diversification Is So Important in 2025

With global uncertainties like inflation fluctuations, political instability, interest rate changes, and emerging technologies disrupting industries, portfolios concentrated in just one asset class (like only stocks or real estate) are more vulnerable to losses.

Here’s why diversification is essential in 2025:

📉 Protects against market volatility

💸 Reduces portfolio risk

📈 Increases potential for long-term growth

🌍 Exposes you to global and emerging market trends

🔁 Balances performance between asset classes

📊 Types of Diversification

1. Asset Class Diversification

Spread your investments across:

Stocks (Equity)

Bonds (Debt instruments)

Real estate

Commodities (like gold, oil)

Mutual funds or ETFs

Cash and equivalents

2. Geographic Diversification

Invest in:

Domestic markets (your country)

Developed international markets (e.g., USA, Europe)

Emerging markets (e.g., India, Brazil, Vietnam)

This reduces the risk from regional economic downturns.

3. Sector Diversification

Don’t just invest in tech or real estate—consider:

Healthcare

Energy

Finance

Consumer goods

Industrials

Sectors perform differently in various market cycles.

4. Time Diversification

Also known as dollar-cost averaging, this involves investing a fixed amount at regular intervals, regardless of market conditions. Over time, this smooths out volatility.

🌍 Emerging Markets & Alternative Assets in 2025

In 2025, smart investors are expanding their strategies by entering emerging markets and exploring alternative assets:

🌱 Emerging Markets

Countries like India, Indonesia, and Kenya are experiencing rapid economic growth. These offer:

High returns potential

Young, tech-savvy populations

Government infrastructure investments

But also come with:

Currency risks

Political instability

Regulatory challenges

💼 Alternative Assets

Besides traditional stocks and bonds, investors are now looking at:

Cryptocurrencies like Bitcoin and Ethereum

NFTs (non-fungible tokens)

Private equity and venture capital

Peer-to-peer lending platforms

REITs (Real Estate Investment Trusts)

These assets can add non-correlated returns to your portfolio but need careful research and risk management.

✅ How to Build a Diversified Portfolio in 2025

1. Start With Your Goals

Are you investing for short-term gains, retirement, or wealth preservation?

2. Understand Your Risk Tolerance

Conservative: More bonds and cash equivalents

Aggressive: More equity and alternative assets

3. Select a Mix of Asset Classes

A balanced portfolio might look like:

40% domestic stocks

25% international stocks

20% bonds

10% real estate/commodities

5% crypto/alternative assets

4. Use Index Funds and ETFs

These provide instant diversification at low costs.

- Review and Rebalance

At least once or twice a year, rebalance your portfolio to maintain your desired allocation. Market performance can shift your ratios over time.

📉 Common Mistakes to Avoid

❌ Over-diversification: Spreading too thin can dilute returns and make portfolio management complicated.

❌ Ignoring fees: Some mutual funds and investment platforms charge high fees that can eat into your profits.

❌ Chasing trends: Don’t blindly invest in hype-driven assets without research.

❌ Neglecting rebalancing: Letting your portfolio go unchecked for years can expose you to unintended risk.

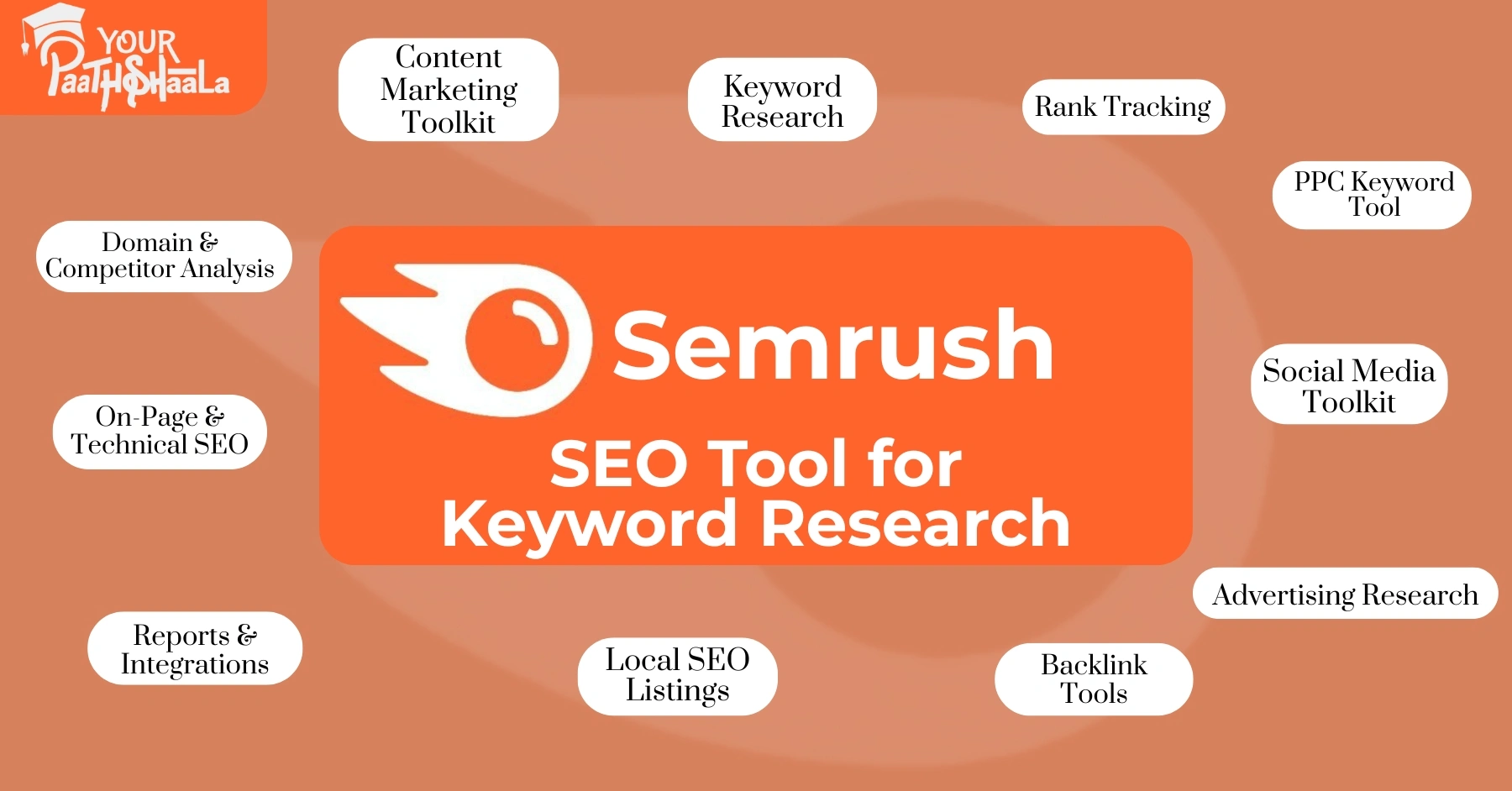

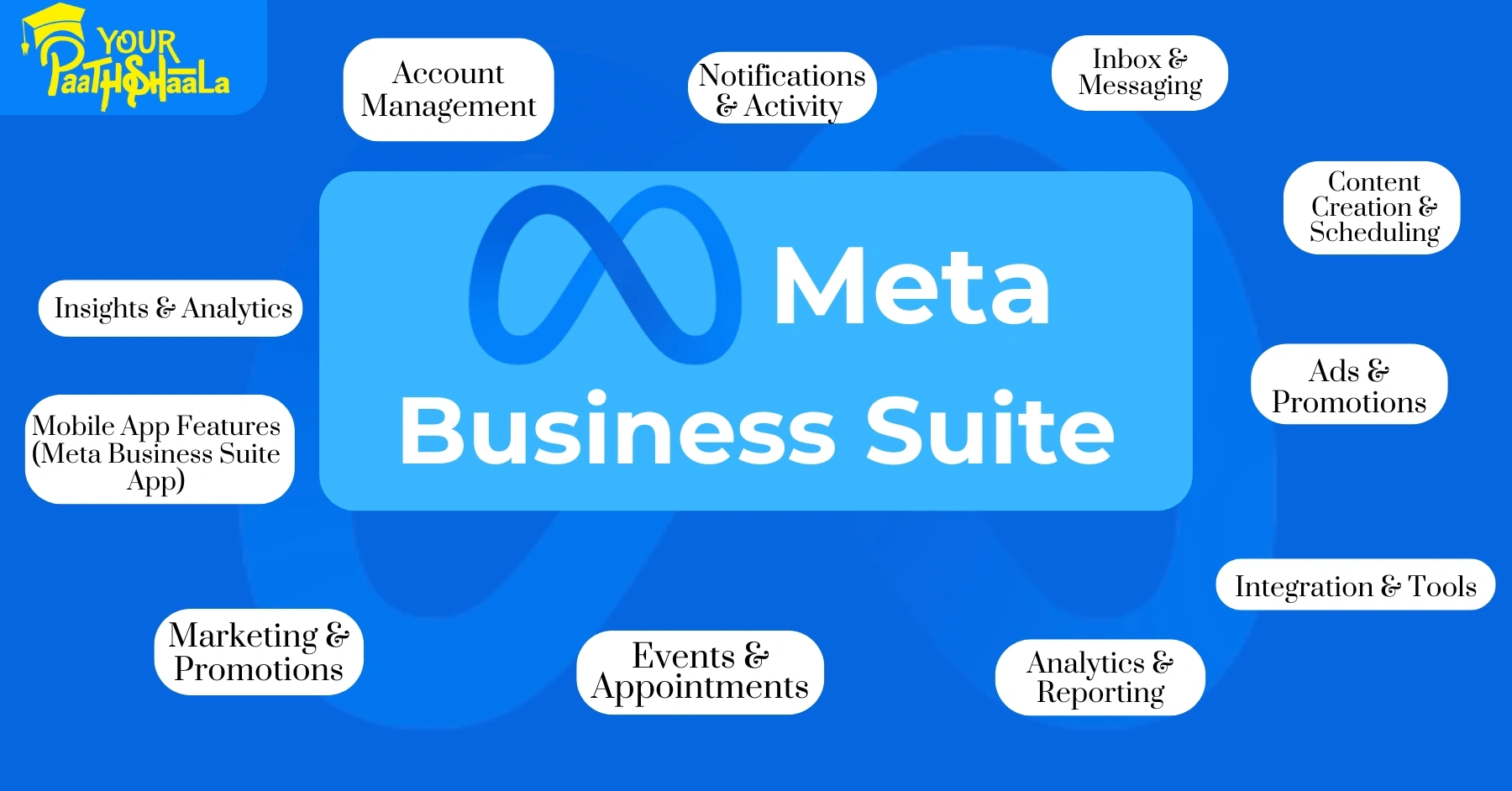

🔍 Tools to Help You Diversify

🧾 Online portfolio management platforms (Zerodha Coin, Groww, Upstox)

📈 Robo-advisors for automated diversification

🏦 SIP (Systematic Investment Plan) tools

💼 Financial advisors for personalized strategy

🚀 Why 2025 Is the Right Time to Diversify

With global economies adapting to AI, green energy, and remote work, the investment landscape is evolving. Those who diversify smartly will ride new growth waves while protecting their capital.

Also, with increased financial awareness in India and globally, younger investors are entering markets early and seeking long-term security with smart allocation.

🏫 Learn Investment Strategies at YourPaathshaala

At YourPaathshaala, we offer practical and beginner-friendly workshops that teach:

Stock and crypto basics

Portfolio diversification

Risk management

Trading and investment psychology

How to build wealth steadily

📍 Visit YourPaathshaala

Near 🏥 Anjali Children Hospital, Tagore Nagar, Mathpurena, Raipur

📫 PIN code: 492001, Chhattisgarh

📞 Click the Call Now to learn more or book your spot today! Check out the full article click here!

[…] Diversification Strategies in 2025 […]

[…] Diversification Strategies in 2025 […]